What Describes That Best Functions of Federal Reserve System

A developing new financial markets and aiding banks in conducting their business B aiding banks in conducting business and managing the US. Asked Jun 16 2016 in Business by Rosalla.

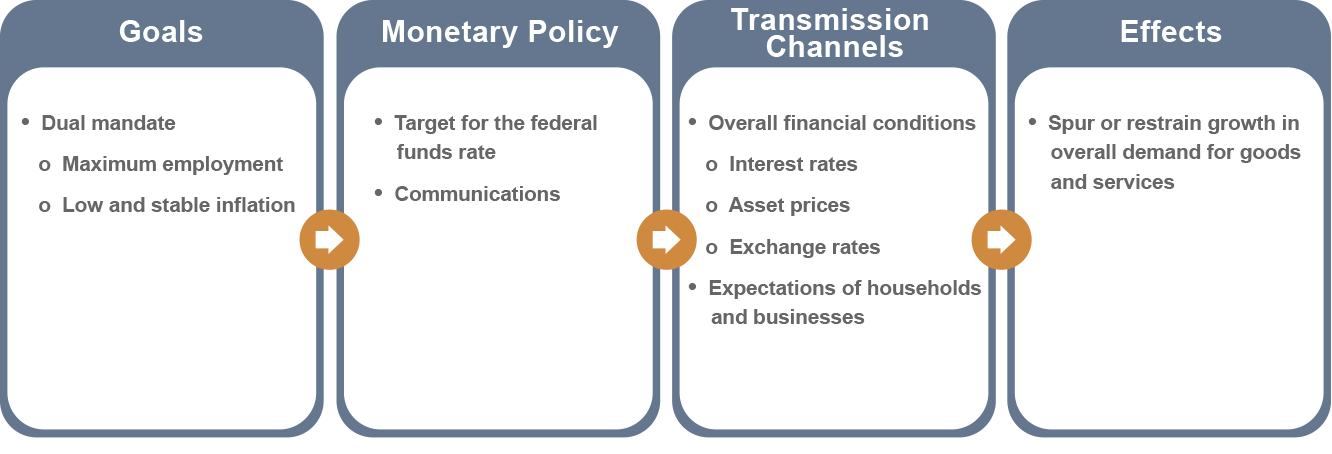

Federal Reserve Board Monetary Policy What Are Its Goals How Does It Work

We review their content and use your feedback to keep the quality high.

. 3- What is the policy directive and who carries it out. Which of the following BEST describes the organization of the Federal Reserve Fed. Economy and more generally the public interest.

Act as a clearinghouse to settle accounts and transactions Transfer economic resources from savers to investors. It proposes bills to Congress on monetary policy. We review their content and use your feedback to keep the quality high.

It is the central bank of the United States of America. Central bank the Federal Reserve carries out a number of functions that affect the nations economic well-being. Which best describes the function of the Federal Reserve System.

In addition to collecting information this function includes seminars reports. 1 on a question What best describes the function of the federal reserve system. Administration of taxes Control of the money supply Oversight of international trade Regulation of commerce.

Oversight of international trade. Through this economic research the Fed is able to advance economic knowledge throughout the bank system and the general public. The function of the Federal Reserve System is the control of the money supply.

The District Banks are a private part of the Federal Reserve System and the Board of Governors are a public part. The Federal Reserve conducts the nations monetary policy to promote maximum. Which best describes the function of the federal reserve system.

Describe the functions of the Fed district banks. It safeguards the US. A central authority called theBoard of Governors in Washington DC and a decentralized network of 12 Federal Reserve Banks located throughout the country.

The Reserve Banks also keep tabs on the local banks and depository institutions in their orbit to make sure theyre financially sound. The Federal Reserve System regulates the nations supply of money and credit to do its best to ensure that the growth of money and credit will be adequate to. Experts are tested by Chegg as specialists in their subject area.

The federal reserve is best described as. The four main functions of financial systems are. Control of money supply.

Aiding banks in conducting business and managing the US. But the Federal Reserve goes beyond this function to conduct research that includes historic information and other economic knowledge. Through monetary policy which influences the availability of money and credit the Fed plays a major role in keeping inflation in check while.

Macro Econ Test Review Game DRAFT. Reserves of gold bullion. I think the correct answer among the choices listed above is option B.

The Federal Reserve does not need the approval of any branch or the President to do anything. The Federal Reserve System Purposes Functions 1 he Federal Reserve System is the central bank of the United States. Its key functions include handling the countrys monetary policy.

Which of the following BEST describes two of the three primary functions of the Federal Reserve System. Developing new financial markets and aiding banks in conducting their business B. Which describes how money functions as a medium of exchange.

It controls the supply of money in the United States. These responsibilities fall into four broad categories. The Council of American Governors Question 40 of 40 25 25 Points Which of the following best describes two of the three primary functions of the Federal Reserve System.

Collection of funds Act as a clearinghouse to settle accounts and transactions. Federal Reserve performs 7 basic functions which are as folows 1 Issue of currency the currency used in the us m. It performs five general functions to promote the effective operation of the US.

The Federal Reserves responsibilities. 100 2 ratings The Federal Reserve System has a two-part structure. It was created to provide a.

1- Briefly describe the origin of the Federal Reserve System. View the full answer. 2- Explain how the Fed increases the money supply through open market operations.

The Reserve Banks hold money for commercial banks which are required by federal law to set aside a percentage of their assets a reserve to prove they can meet their obligations. Money supply and interest rates. Which statement describes the role of the Federal Reserve System.

The Federal Reserve System FRS also known as the Fed is the US. Acting as a bank for the federal government and developing new financial markets. Choose four Savings and investment.

A Developing new financial markets and aiding banks in conducting their business. The Federal Reserve is a central bank created by Congress. The President of the United States D.

4- How is money supply growth affected by an increase in the reserve requirement ratio. Which of the following BEST describes two of the three primary functions of the Federal Reserve System. It prints all the paper money in circulation in the United States.

About The Fed An Introduction To The U S Central Bank Federal Reserve History

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Role_of_the_Fed_Jun_2020-01-02efe1c99128421195f2a3c68737d792.jpg)

Federal Reserve System Frs Definition

/dotdash_Final_Federal_Reserve_Bank_of_St_Louis_May_2020-01-b24eb0d4195b4aa2993db793450866f1.jpg)

Federal Reserve Bank Of St Louis

/dotdash_Final_Federal_Reserve_Bank_of_San_Francisco_May_2020-01-6fc5b14f38a34fd4be857e1fe090d7eb.jpg)

Federal Reserve Bank Of San Francisco

Does Budget Feel Like The Dreaded B Word To You Too Take The Stress Out Of Planning Your Expenses And Get Your Spend Money Smart Week Smart Money B Words

:max_bytes(150000):strip_icc()/Clipboard01-5f81c3d8028b4eb8b1fc5f704d05ea75.jpg)

Federal Reserve System Frs Definition

Thehrdirector Employee Morale Company Culture Human Resources

Federal Reserve The Fed History Function Structure Of Central Bank

Federal Reserve System Frs Definition

The Fed S Board Of Governors National Geographic Society

Mmt White Paper 7 26 2021 White Paper Accounting Thoughts

Metatrader 4 Vs Metatrader 5 Ultimate Comparison Of Trading Platforms Kitchen Design Software Free Software Design Kitchen Design Software

Pin By Kcl On Hrbp In 2021 Business Partner Evaluation Employee Partners

/dotdash_Final_Federal_Reserve_Bank_of_Kansas_City_May_2020-01-1590dcdec5704f94a8f1706596aaaea0.jpg)

Federal Reserve Bank Of Kansas City Definition

7 Ways The Federal Reserve Affects You And Your Money The Motley Fool

Mmt White Paper 7 26 2021 White Paper Accounting Thoughts

The Federal Reserve Is The Central Bank Of The Us Here S Why It S So Powerful And How It Affects Your Financial Life Federal Reserve Capital Gains Tax Financial Decisions